Products

Advanced Reception Management (ARM)

Advanced Cheque Automation (ACA)

Advanced Bill Payment (ABP)

Advanced Digital Signage (ADS)

Advanced Customer Survey (ACS)

Mobile Point of Sale (mPOS)

Partners

For Banks & Financial Institutions, Telco’s, Utility Companies,

Government and Other Organizations.

The mantra, “do more with less” pervades today’s business climate, and companies are increasingly embracing Customer Self Service.

Cheques will continue to remain the payment instruments of choice especially for business transactions in the foreseeable future.

24 Hours Cheque deposit facility

24 Hours Cheque deposit facility

Hassle free from filling up pay slip

Hassle free from filling up pay slip

Scanned copy of the cheque along with receipt as a proof

Scanned copy of the cheque along with receipt as a proof

MICR reader for accepting cheques.

MICR reader for accepting cheques.

Ready for Image Cheque Clearing (ICC)

Ready for Image Cheque Clearing (ICC)

High speed transport and scanning

High speed transport and scanning

Easy to use Application with touch screen keypad

Easy to use Application with touch screen keypad

Clear on screen instructions with graphics

Clear on screen instructions with graphics

Transaction detail printout in any language

Transaction detail printout in any language

Front and rear cheque scanning

Front and rear cheque scanning

Front and rear endorsement

Front and rear endorsement

Integration with Core Banking & Other Systems

Integration with Core Banking & Other Systems

Central administration and reporting

Central administration and reporting

Limited data to fill of account holder

Limited data to fill of account holder

Touch Screen Facility with Dual Screen

Touch Screen Facility with Dual Screen

Reduce work for Bank Employee

Reduce work for Bank Employee

Easily Integrated with the Banking Application

Easily Integrated with the Banking Application

Long queues lead to disgruntled customers

Long queues lead to disgruntled customers

Rising manpower costs

Rising manpower costs

Multi-lingual

Multi-lingual

The mantra, “do more with less” pervades today’s business climate, and companies are increasingly embracing Customer Self Service.

Cheques will continue to remain the payment instruments of choice especially for business transactions in the foreseeable future.

- Overview

- Features

- Gallery

- Models

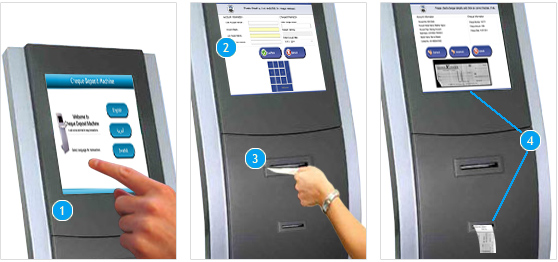

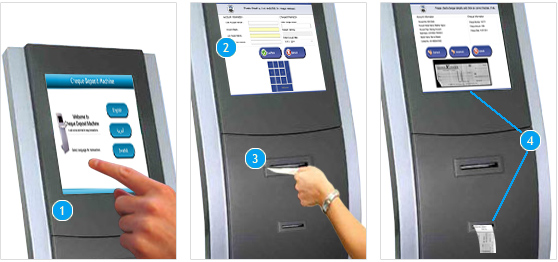

ACA Kiosk machines are designed to handle all cheques without any intervention from the employees, while providing customers with printed acknowledgement receipt. The check deposit kiosk allows the customer to deposit a check 24x7. ACA Kiosk Consists of Touch Screen, Cheque Scanner, Thermal Printer with Application can be integrated with Banking application.

ACA automate the acceptance of cheque for processing, without having to fill up deposit slip for customer and reduce the work of employees to do the data entry work as today most of the banks do. Customer gets the Deposit slip with all the information and scanned cheque image.

ACA Features Cheque Truncation which is one of the most convenient and the faster way to process the clearances of local and intercity cheque using electronic records of the content or image of cheque instead of physical movement of cheque within bank or between bank.

MICR technology enabled the banking system to handle the growth in the cheque volumes and to provide faster and efficient clearing services to customers and to do straight through processing using MICR data.

ACA helps to improve Customer Service and build good and satisfactory customer relations ships.

ACA gives Return on investment and increase their productivity, Business and branding of Banks.

ACA comes with high resolution touch screen with 2nd optional display and high end MICR & Image scanner.

ACA provides Quick process, easy and secure transaction.

ACA automate the acceptance of cheque for processing, without having to fill up deposit slip for customer and reduce the work of employees to do the data entry work as today most of the banks do. Customer gets the Deposit slip with all the information and scanned cheque image.

ACA Features Cheque Truncation which is one of the most convenient and the faster way to process the clearances of local and intercity cheque using electronic records of the content or image of cheque instead of physical movement of cheque within bank or between bank.

MICR technology enabled the banking system to handle the growth in the cheque volumes and to provide faster and efficient clearing services to customers and to do straight through processing using MICR data.

ACA helps to improve Customer Service and build good and satisfactory customer relations ships.

ACA gives Return on investment and increase their productivity, Business and branding of Banks.

ACA comes with high resolution touch screen with 2nd optional display and high end MICR & Image scanner.

ACA provides Quick process, easy and secure transaction.

Software Products

ARM

Advanced Reception Management

ACA

Advanced Cheque Automation

ABP

Advanced Bill Payment

ADS

Advanced Digital Signage

ACS

Advanced Customer Survey

mPOS

Mobile Point of Sale

ARM

Advanced Reception Management

ACA

Advanced Cheque Automation

ABP

Advanced Bill Payment

ADS

Advanced Digital Signage

ACS

Advanced Customer Survey

mPOS

Mobile Point of Sale

Copyright © 2012 Diamond Data. All rights reserved.